Reward

& Recognize

Employees, Customers

and Dealer incentives

Rewards • Incentive • Connect • Engagement • Recognize

Digital incentive programs

that meet your needs.

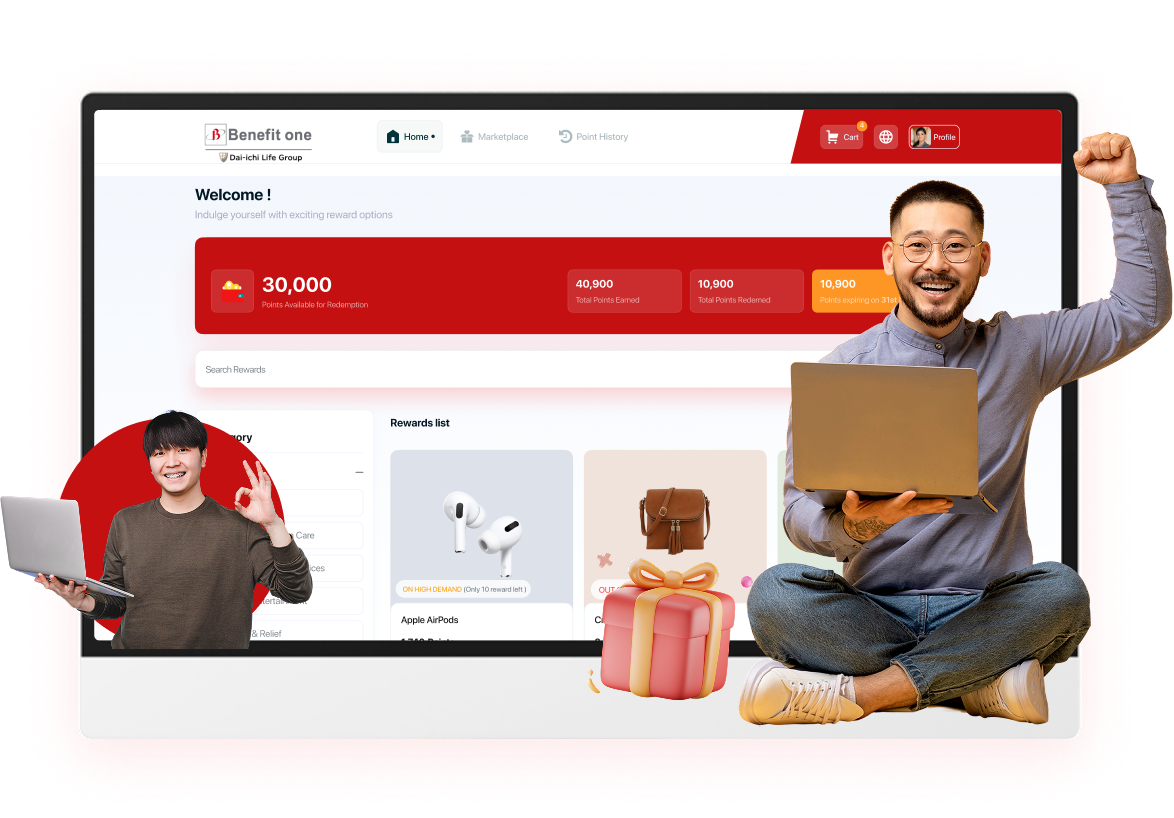

Loyalty & Engagement Platform

Build customized CRM solutions to drive customer and employee engagement

Rewards & Privileges

Sourcing and managing deals and products privileges

LUCKY DRAW SERVICES

Seamless lucky draw management with automated entries, winner selection, and prize distribution

HR & employee incentives

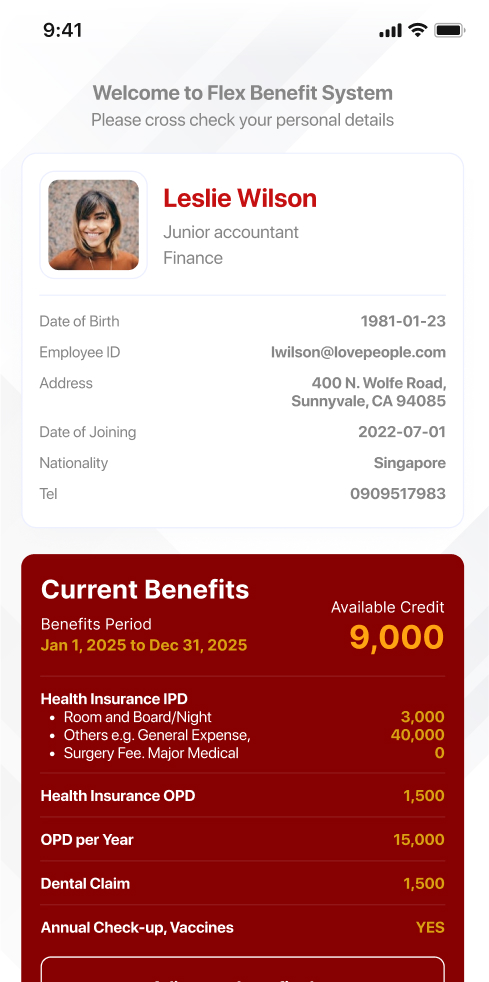

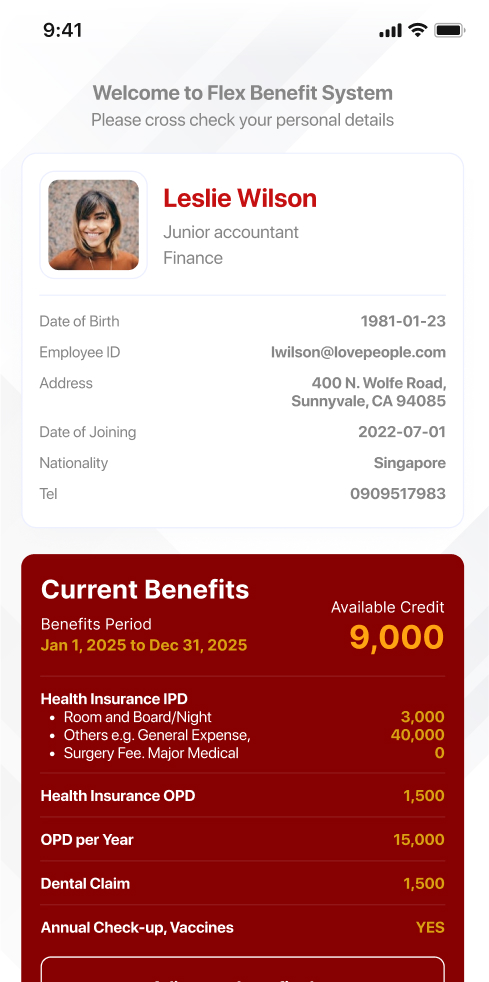

FLEXIBLE BENEFIT PLATFORM

Enhance employee experiences with meaningful and flexible recognition programs

Data-Driven Insights

Unlock actionable analytics to improve engagement strategies and reward effectiveness

How we help

We Empower You to Reward & Recognize

With Ease Everyday

Alignment with your corporate objectives

From recognising employees, driving channel sales, and building customer loyalty, our point-based CERRA platforms and SPUR reward marketplace can catalyse corporate objectives, making it an ideal rewards and recognition program in Singapore and globally.

Real, visible, meaningful, recognition

Our global rewards and recognition program is designed to create moments of joy, boost morale, foster a culture of recognition, and improve motivation and focus while making users feel appreciated.

Curated relevant local rewards

We offer an extensive catalogue of rewards that are aligned with your corporate values and relevant to your global user base, embodying the essence of a digital rewards marketplace in Singapore and beyond.

Data-driven decisions

Draw insights about your users’ recognition and redemption behaviours, identify individual strengths, and so much more using our specially designed analytic dashboards, enhancing the effectiveness of your employee rewards program.

Improved communication

The easy-to-use, seamless communication features of our rewards and recognition programs help you strengthen connections within your company, with partners, channel networks, and customers in Singapore and beyond.

Strengthen connections

within your company, partners

and customers.

Our engagement solutions have a proven track record of boosting morale, fostering recognition, improving motivation and focus, while making users feel appreciated.

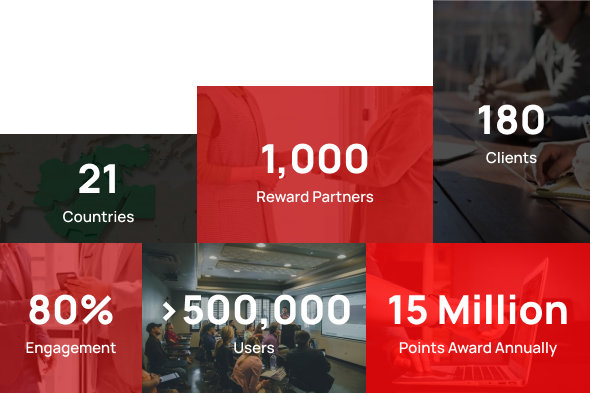

Trusted engagement partner of the world's leading companies

Who We Are?

Dai-ichi Life Group

Our group companies are contributing to communities around the world through life insurance and asset management businesses. We continue to take up new challenges for our customers and society.

Over 7,500 companies in Japan, including government organizations, have entrusted Benefit One for its services. Our services and network are the largest of its kind in Japan. Benefit One is now enabling our clients to retain top performers and make the lives of both the clients and employees easier by using our HR technology services in Thailand.

In Thailand, we are providing a new incentive and recognition program for employees while working with distributors and vendors as part of our service. Our focus is to gain overall emotional commitment, create highly motivated employees, and make a positive impact on your company.

Our mission is to provide better services/products

at cheaper prices and more convenience.

And to deliver pleasure and excitement to every clients.

We believe the Benefit One Point System will effectively help your company to improve retention and motivation for your stakeholders, strengthen your corporate culture, and boost your sales dramatically.

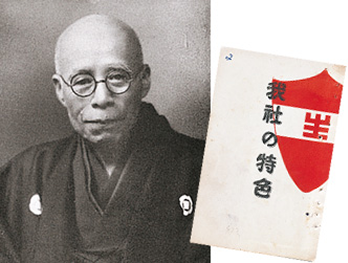

History (1900-)

More than a century since the foundation, we continue to take up new challenges for customers and society.

1902

Foundation

Tsuneta Yano issues “Characteristics of

My Company”, a pamphlet explaining

the merits of a mutual company, and

subsequently establishes Japan’s first

mutual life insurance company,

the Dai-ichi Mutual Life Insurance Company

Left: Tsuneta Yano

Right: “Characteristics of My Company”

1906

Dai-ichi Life begins paying policyholder dividends.

1923

The sum insured of policies in-force reaches JPY 1 billion. Dai-ichi Life becomes the second largest life insurance company in Japan.

1935

Dai-ichi Life establishes the “Hoseikai” foundation, offering facilities for the prevention and treatment of tuberculosis, the major cause of death in Japan at the time.

1938

The Head Office is moved to its current Tokyo location, which served as the General Headquarters of the Allied Powers (GHQ) following World War II.

1950

Foundation

Dai-ichi Life establishes the Public Health Award, honoring the efforts of groups and individuals who make outstanding contributions in the field of public health and hygiene.

Presentation ceremony for the

1st Public Health Award

1970

To expand Dai-ichi Life’s support for the life insurance business in Asia, Dai-ichi Life establishes FALIA, The Foundation for the Advancement of Life Insurance in Asia (currently: The Foundation for the Advancement of Life & Insurance Around the world).

1975

Dai-ichi Life‘s first overseas representative office is established in New York to study U.S. insurance, economic, and financial systems as well as to promote international group insurance policies among local subsidiaries of Japanese corporations.

(Currently operates as DLI NORTH AMERICA INC. after strengthening its function as Regional Headquarters.)

1982

Dai-ichi Life’s first European representative office is established in London (currently Dai-ichi Life International (Europe) Limited).

1988

Dai-ichi Life establishes Dai-ichi Life International (H.K.) Limited.

(Currently closed after DLI ASIA PACIFIC PTE. LTD started operation in Singapore.)

1990

Together with the organization for Landscape and Urban Green Infrastructure, Dai-ichi Life establishes and starts co-hosting The Green Design Award (currently The Green Environmental Plan Award), which commends and subsidizes excellent works to improve urban environments.

1993

Dai-ichi Life completes the DN Tower 21, a new Head Office building in the heart of Tokyo (currently Dai-ichi Life Hibiya First).

1995

Following the Great Hanshin Earthquake, Dai-ichi Life simplifies claims settlement procedures.

1996

Dai-ichi Life raises foundation funds worth JPY 69 billion.

1997

Dai-ichi Life establishes Dai-ichi Life Research Institute Inc.

1998

Dai-ichi Life enters into the investment trust business as Dai-ichi Life Asset Management Co., Ltd.

Dai-ichi Life raises additional foundation funds worth JPY 150 billion.

Dai-ichi Life reaches an agreement on total business cooperation with the Industrial Bank of Japan, Ltd. (currently Mizuho Financial Group, Inc.).

1999

Dai-ichi Life and the Industrial Bank of Japan Co., Ltd. establish IBJ-DL Financial Technology Co., Ltd. (currently Mizuho-DL Financial Technology Co., Ltd.).

Dai-ichi Life Asset Management Co., Ltd., IBJ NW Asset Management Co., Ltd. and IBJ Investment Trust Management Co., Ltd. merge to form DLIBJ Asset Management Co., Ltd. (renamed DIAM Co., Ltd. in 2008).

2000

Dai-ichi Life enters into an agreement to form a comprehensive business alliance with the Yasuda Fire and Marine Insurance Co., Ltd. (currently Sompo Japan Insurance Inc.) and a strategic marketing alliance with American Family Life Assurance Company of Columbus (currently AFLAC).

2001

Dai-ichi Life wins the “Japan Quality Award”, the first company in the financial and insurance industry to receive this honor.

2002

Marking a century of insurance and investment achievements, Dai-ichi Life celebrates its 100th Anniversary.

Dai-ichi Life raises additional foundation funds worth JPY 80 billion through public offering using a securitization scheme.

2003

Dai-ichi Life issues subordinated bonds worth JPY 30 billion for public subscription using a securitization scheme.

2004

Dai-ichi Life issues U.S. dollar-denominated subordinated bonds in the global capital market.

Dai-ichi Life raises additional foundation funds worth JPY 60 billion through public offering using a securitization scheme.

2006

Dai-ichi Life raises additional foundation funds worth JPY 60 billion through public offering using a securitization scheme.

2007

Dai-ichi Life acquires Bao Minh CMG, which recommences operations as Dai-ichi Life Insurance Company of Vietnam, Ltd.

Dai-ichi Life’s wholly-owned subsidiary, Dai-ichi Frontier Life Insurance Co., Ltd., obtains a license for life insurance business.

Dai-ichi Life concludes a joint-venture contract to establish a joint life insurance company (Star Union Dai-ichi Life Insurance Company Limited) with the Bank of India and Union Bank of India.

2008

Dai-ichi Life adopts a plan to demutualize and become a stock company.

Dai-ichi Life concludes an agreement on a strategic business alliance, including the acquisition of shares, with Ocean Life Insurance Co., Ltd. (currently OCEAN LIFE INSURANCE PUBLIC COMPANY LIMITED) of Thailand.

Dai-ichi Life enters into an agreement to form a strategic business alliance with TOWER Australia Group Limited (TOWER Australia).

2009

Star Union Dai-ichi Life Insurance Company Limited commences sales of its products.

Dai-ichi Life enters into a JPY183 billion syndicated subordinated loan.

The 108th general meeting of representative policyholders approves Dai-ichi Life’s demutualization.

2010

Dai-ichi Life demutualizes and is listed on the Tokyo Stock Exchange.

2012

Dai-ichi Life enters into a strategic business and capital alliance with Janus Capital Group Inc., a U.S. asset management company. Janus became an affiliate in 2013.

Janus merged with Henderson Group in 2017, becoming a new company (Janus Henderson Group plc).

(2021: Dai-ichi Life Holdings dissolves its capital alliance with Janus Henderson Group.)

2013

Dai-ichi Life acquires shares in PT Panin Life (currently PT Panin Dai-ichi Life), an Indonesian life insurance company, which becomes an affiliate.

Dai-ichi Life adopts “By your side, for life” as group mission for the Dai-ichi Life Group

2014

Dai-ichi Life joins the United Nations Global Compact, the largest voluntary corporate responsibility initiative in the world, working towards the vision of a sustainable and inclusive global economy.

Dai-ichi Life concludes an agreement with Protective Life Corporation, a U.S. life insurance group listed on the New York Stock Exchange, on the commencement of procedures to acquire 100% ownership of the company.

Dai-ichi Life issues new shares worth JPY 265.6 billion.

Dai-ichi Life successfully acquires 100% ownership of Sompo Japan DIY Life Insurance Co., Ltd. (currently The Neo First Life Insurance Company, Limited).

2014

Dai-ichi Life successfully acquires 100% ownership of Protective Life Corporation.

Dai-ichi Life issues U.S. dollar-denominated subordinated bonds in the global capital market.

North America Regional Headquarters DLI NORTH AMERICA INC. and Asia Pacific Regional Headquarters DLI ASIA PACIFIC PTE.LTD. start operation.

2016

Dai-ichi Life enters into a strategic business alliance with Japan Post Insurance Co., Ltd.

DIAM Co., Ltd., Mizuho Asset Management Co., Ltd., Mizuho Trust & Banking Co., Ltd. and Shinko Asset Management Co., Ltd., merge to form Asset Management One, Co., Ltd.

Dai-ichi Life shifts to a Holding Company Structure.

2018

Dai-ichi Life Holdings establishes QOLead Co., Ltd.

2019

Dai-ichi Life Insurance (Cambodia) PLC., a wholly-owned subsidiary of Dai-ichi Life Holdings, Inc., begins operations.

Dai-ichi Life Holdings establishes Dai-ichi Life Realty Asset Management Co., Ltd.

2020

Dai-ichi Smart Small-amount and Short-term Insurance Company, Limited is established.

Dai-ichi Life Insurance Myanmar Ltd., a wholly-owned subsidiary of Dai-ichi Life Holdings, Inc., begins operations.

2022

Dai-ichi Life Holdings establishes Vertex Investment Solutions Co., Ltd.

Dai-ichi Life Holdings successfully acquires 100% ownership of Partners Group Holdings Limited.

2023

Dai-ichi Life Holdings successfully acquires 100% ownership of ipet Holdings, Inc. (currently ipet Insurance Co., Ltd.).

2024

The Dai-ichi Life Group adopts “Partnering with you to build a brighter and more secure future” as its Group Purpose.

Dai-ichi Life Holdings successfully acquires 100% ownership of Benefit One, Inc.

INCENTIVE Points

Connect • Engage • Recognize • Reward • Appreciate

Employee Engagement

Incentive and recognize your employees with peer appreciations, flexible benefits, and more

Customer Loyalty

Reward your customers for their loyalty with an attractive range of reward partners

Channel Incentives

Incentivise and motivate your channel partners to grow your business

Loyalty Program

via LINE OA

Designed for Modern Businesses

Designed for Modern Businesses

Accelerate your customer engagement with a seamless loyalty program fully integrated with your LINE Official Account. No additional apps or downloads required.

Customers can earn points and redeem rewards instantly through LINE.

This solution enables businesses to reduce customer acquisition costs, save operational time, and launch a customer retention program quickly and effectively. Strengthen your customer base and drive loyalty with a system built for speed and convenience.

One-stop digital rewards solutions

Flexible Benefit Platform, Tailored for Your Projects

Unique & Relevant Spot Rewards

Award points for customizable activities, redeemable for discounts and premium rewards across F&B, retail, travel, and services.

Improved Communication

Boost engagement with birthday wishes, seasonal greetings, and fitness tracking. Promote mental wellness with AI-powered nudges and mood updates.

Unique & Relevant Spot Rewards

Strengthen connections with interactive features like announcements, polls, and media sharing in real-time.

Increased Productivity & Revenue

Enhance collaboration and performance with tools for instant updates, polls, and feedback—perfect for teams and partners.

Real-Time Engagement Statistics

Monitor engagement, track behavior patterns, and measure campaign effectiveness with real-time analytics.

Dedicated Account Manager

Partner with experienced account managers to build engagement and loyalty programs tailored to your business goals.

Integration

We Connect Seamlessly

Seamless integrations of our workplace reward program with HRMS, Single Sign-On with secure authentication, communication platforms, messaging apps, GPT3 and more

Over 20+ Integrations with your Tech Infrastructure & Platforms

Engage USERS • Build Loyalty • Motivate Teams

Make Data-Driven Decisions

Appreciation Insights

Gain insights into how peer-to-peer appreciations are sent between employees and across departments, identify internal ambassadors for your core values, and highlight influencers that send and receive the most appreciations.

Appreciation Insights

Gain insights into how peer-to-peer appreciations are sent between employees and across departments, identify internal ambassadors for your core values, and highlight influencers that send and receive the most appreciations.

Appreciation Insights

Gain insights into how peer-to-peer appreciations are sent between employees and across departments, identify internal ambassadors for your core values, and highlight influencers that send and receive the most appreciations.

75%

Engagement Rate

Get ready to engage

and incentivise the smarter way

Contact Us

First, let’s connect on your goals and plans!

Contact us today to get a demo for your business. Simply share some info and we’ll be in touch soon.

No. 235/3,235/4,235/5, 4th Floor, Unit no. 6 Sukhumvit 21 (Asoke) Road, Khlong Toey Nuer, Wattana, Bangkok 10110

Stay Tuned With Us

Support@benefit-one.co.th

Contact@benefit-one.co.th